Tulsa Bankruptcy Lawyer: The Impact Of Bankruptcy On Your Retirement Savings

Table of ContentsBankruptcy Attorney Tulsa: The Impact Of Credit Card Debt On BankruptcyTulsa, Ok Bankruptcy Attorney: How Bankruptcy Affects Your BusinessBankruptcy Lawyer Tulsa: Understanding Home Equity And Bankruptcy ExemptionsTulsa Bankruptcy Lawyer: The Difference Between Secured And Unsecured Debts

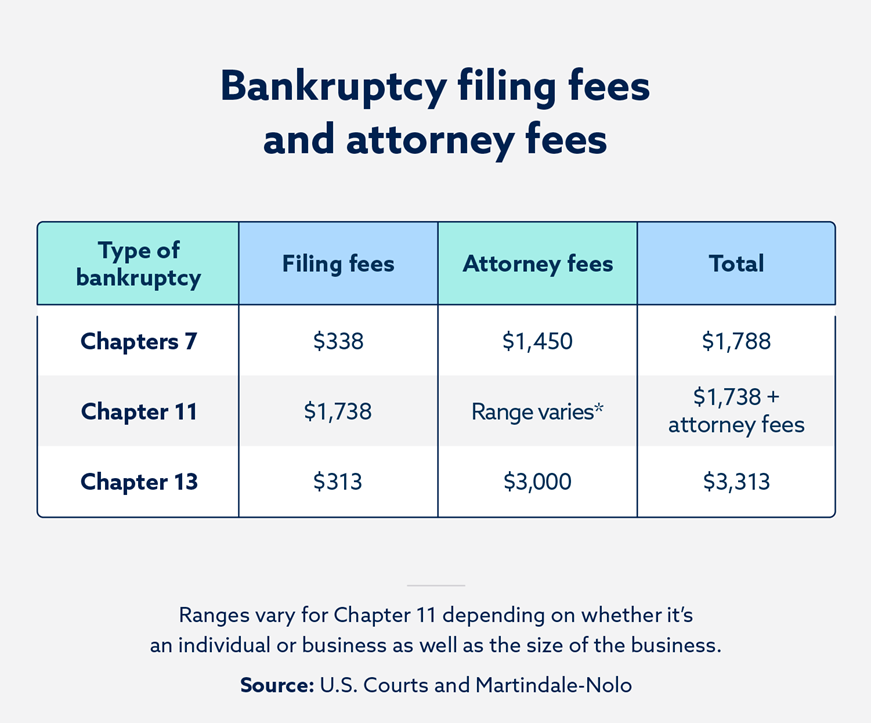

It can harm your credit report for anywhere from 7-10 years and be an obstacle towards getting safety and security clearances. If you can not resolve your troubles in much less than 5 years, personal bankruptcy is a practical option. Attorney fees for personal bankruptcy differ depending on which develop you select, exactly how complex your situation is as well as where you are geographically. bankruptcy lawyer Tulsa.Various other insolvency expenses consist of a filing cost ($338 for Phase 7; $313 for Phase 13); and also costs for debt counseling as well as economic management courses, which both expense from $10 to $100.

You don't always require an attorney when submitting individual bankruptcy on your very own or "pro se," the term for representing yourself. If the instance is basic enough, you can file for insolvency without assistance.

The general policy is the easier your personal bankruptcy, the better your opportunities are of finishing it on your very own and obtaining a personal bankruptcy discharge, the order getting rid of financial obligation. Your situation is most likely simple enough to take care of without a lawyer if: Nevertheless, even simple Chapter 7 cases call for work. Plan on loading out substantial documentation, gathering economic documents, investigating bankruptcy and also exception laws, as well as adhering to regional regulations and also procedures.

Tulsa, Ok Bankruptcy Attorney: How Bankruptcy Affects Your Business

Right here are two situations that constantly ask for depiction. If you possess a small company or have earnings over the typical degree of your state, a significant amount of properties, concern financial debts, nondischargeable financial obligations, or financial institutions that can make claims against you based upon fraudulence, you'll likely desire a legal representative.

If you make a mistake, the bankruptcy court might toss out your instance or market assets you assumed you might keep. If you shed, you'll be stuck paying the financial debt after bankruptcy.

If you make a mistake, the bankruptcy court might toss out your instance or market assets you assumed you might keep. If you shed, you'll be stuck paying the financial debt after bankruptcy. You may wish to file Phase 13 to capture up on mortgage debts so you can keep your house. Or you might desire to remove your bank loan, "pack down" or reduce an auto loan, or repay a financial debt that won't disappear in insolvency gradually, such as back tax obligations or assistance defaults.

You may wish to file Phase 13 to capture up on mortgage debts so you can keep your house. Or you might desire to remove your bank loan, "pack down" or reduce an auto loan, or repay a financial debt that won't disappear in insolvency gradually, such as back tax obligations or assistance defaults.In numerous situations, an insolvency lawyer can quickly identify issues you might not identify. Some people file for insolvency because they do not understand their alternatives.

Tulsa Bankruptcy Lawyer: The Impact Of Bankruptcy On Family Law Cases

For many customers, the logical options are Phase 7 and also Phase 13 personal bankruptcy. Each kind has certain benefits that address particular issues. As an example, if you wish to conserve your home from foreclosure, Chapter pop over to this website 13 could be your best option. Phase 7 might be the method to go if you have low income and also no properties.

Here are typical problems personal bankruptcy attorneys can protect against. Insolvency is form-driven. Numerous self-represented personal bankruptcy borrowers don't submit all of the required personal bankruptcy documents, and also their case gets disregarded.

You don't lose every little thing in insolvency, however keeping building relies on recognizing just how home exceptions work. If you stand to navigate to this web-site lose important residential or commercial property like your house, auto, or other property you care around, an attorney may be well worth the money. In Chapters 7 as well as 13, bankruptcy filers need to get credit scores counseling from an authorized company before submitting for bankruptcy and also finish a economic monitoring program prior to the court releases a discharge.

The majority of Chapter 7 cases relocate along naturally. You submit for insolvency, attend the 341 meeting of creditors, as well as get your discharge. Not all personal bankruptcy situations proceed smoothly, and various other, much more complex concerns can arise. Lots of self-represented filers: don't comprehend the relevance of activities and opponent actions can't adequately defend against an activity seeking to refute discharge, and have a difficult time abiding with confusing insolvency treatments.

Overcoming Debt: How A Tulsa, Ok Bankruptcy Attorney Can Help

Or another thing might turn up. The bottom line is that a lawyer is essential when you locate on your own on the obtaining end of an activity or suit. If you choose to declare bankruptcy by yourself, discover what solutions are readily available in your area for pro se filers.

, from sales brochures defining low-priced or free solutions to comprehensive information about personal bankruptcy. Look for an insolvency publication that highlights situations calling for an attorney.

You have to precisely submit numerous forms, research the law, as well as participate in hearings. If you recognize bankruptcy regulation but would like assistance finishing the forms (the average bankruptcy request is around 50 pages long), you could consider employing a bankruptcy request preparer. A personal bankruptcy request preparer is anybody or organization, apart from an attorney or somebody who benefits an attorney, that charges a charge to prepare bankruptcy records.

Due to the fact that bankruptcy request preparers are not attorneys, they can't offer lawful recommendations or represent you in insolvency court. Particularly, they can not: inform you which sort of bankruptcy to file inform you not to list certain financial obligations inform you not to provide particular assets, or inform you what residential or commercial property to exempt.

Due to the fact that bankruptcy request preparers are not attorneys, they can't offer lawful recommendations or represent you in insolvency court. Particularly, they can not: inform you which sort of bankruptcy to file inform you not to list certain financial obligations inform you not to provide particular assets, or inform you what residential or commercial property to exempt.